Condo Insurance in and around Austin

Looking for outstanding condo unitowners insurance in Austin?

State Farm can help you with condo insurance

- San Antonio

- Houston

- Georgetown

- Sun City

- Four Points

- Tarry Town

- Oak Hill

- Northwest Hills

- Wimberley

- Dripping Springs

- Dallas

- Lago Vista

- Lakeway

- Westlake

- Lake Travis

- Cedar Park

- Jonestown

- Leander

- Liberty Hill

- Round Rock

- Buda

- Wells Branch

- Pflugerville

- Austin

Your Personal Property Needs Coverage—and So Does Your Condominium.

Things do happen.. Whether damage from hail, smoke, or other causes, State Farm has terrific options to help you protect your condo and personal property inside against unanticipated circumstances.

Looking for outstanding condo unitowners insurance in Austin?

State Farm can help you with condo insurance

Protect Your Condo With Insurance From State Farm

Despite the possibility of the unpredictable, the future looks bright when you have the excellent coverage that Condo Unitowners Insurance with State Farm provides. More than just protection for your unit and personal property inside, you'll also want to check out possible discounts options for replacement costs, and more! Agent Evan Spielvogel can help you create a policy based on your needs.

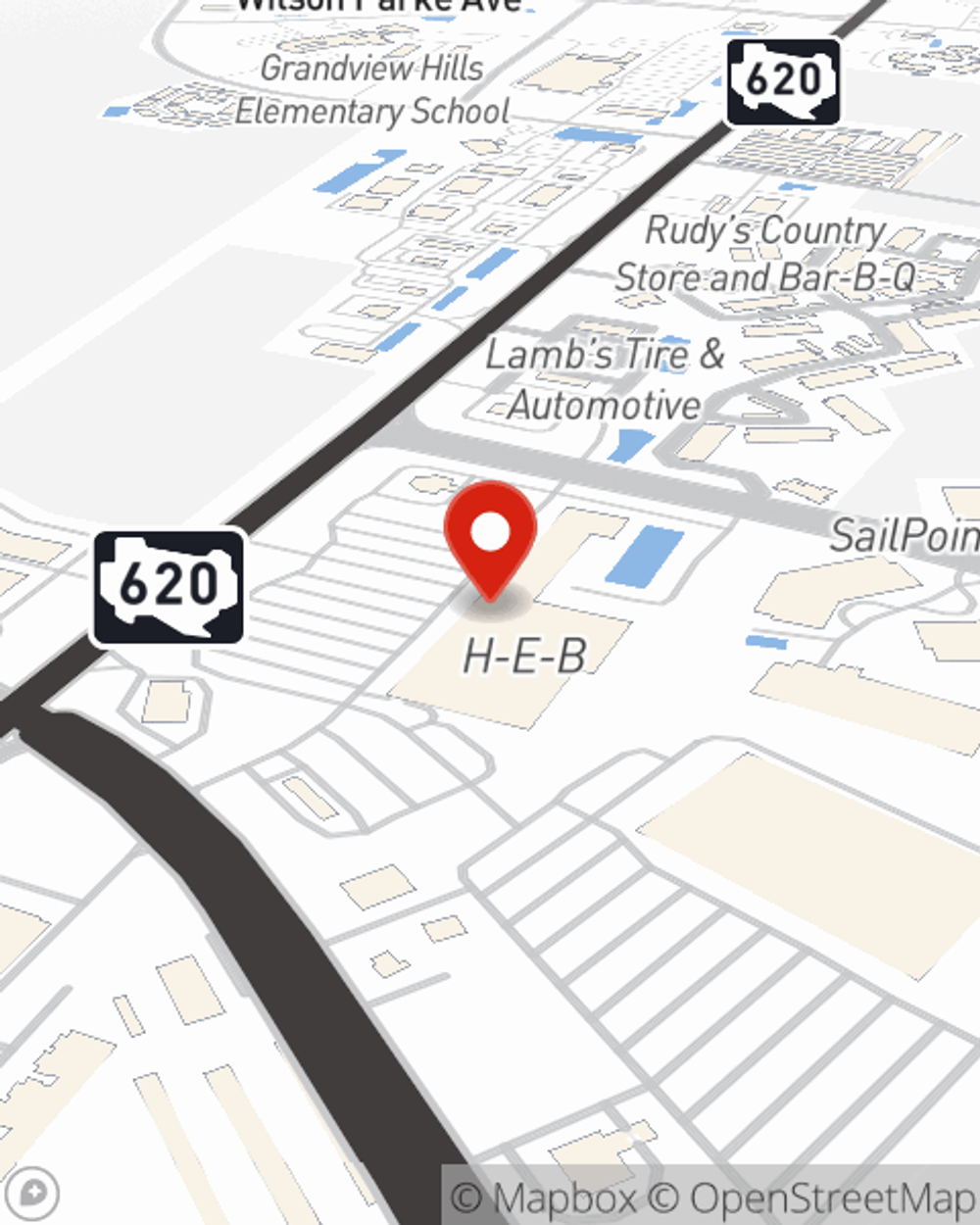

Reach out to State Farm Agent Evan Spielvogel today to discover how one of the top providers of condo unitowners insurance can help protect your townhome here in Austin, TX.

Have More Questions About Condo Unitowners Insurance?

Call Evan at (512) 335-0051 or visit our FAQ page.

Simple Insights®

Pros and cons of buying a condo

Pros and cons of buying a condo

Thinking about buying a condo? Take a look at this list before you make the big decision. It’ll help you weigh the pros and cons of condo living.

A condo maintenance checklist for every season

A condo maintenance checklist for every season

Whether you rent or own a condo, it's important to pay attention to maintenance. Get your condo ready for upcoming weather with these maintenance tips.

Evan Spielvogel

State Farm® Insurance AgentSimple Insights®

Pros and cons of buying a condo

Pros and cons of buying a condo

Thinking about buying a condo? Take a look at this list before you make the big decision. It’ll help you weigh the pros and cons of condo living.

A condo maintenance checklist for every season

A condo maintenance checklist for every season

Whether you rent or own a condo, it's important to pay attention to maintenance. Get your condo ready for upcoming weather with these maintenance tips.